Setting up a disabled trust

We can set up trust funds for a disabled family member. Get in touch with our Trust solicitors in North Yorkshire for assistance.

Contact us to set up a trust fund for a disabled person

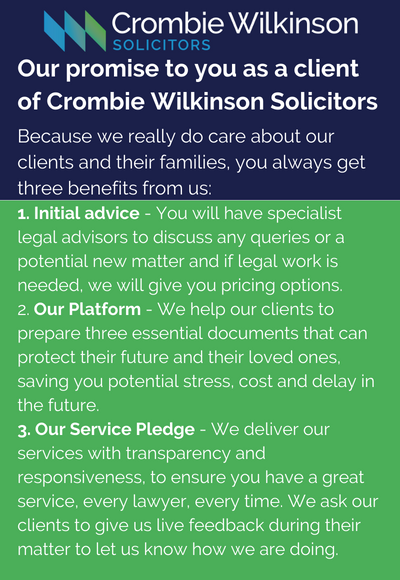

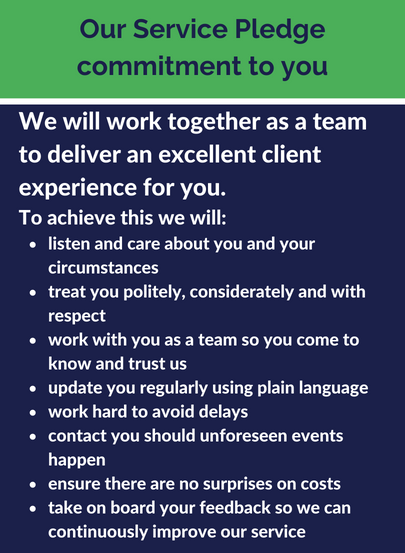

How can Crombie Wilkinson's team of solicitors help?

We have an expert team of Trust Fund Solicitors ready to guide you through the process of setting up a disability trust. Contact us today for more information, or alternatively, you can fill out the contact form to the right.

Setting up a trust for a disabled family member

You can set up any sort of trust fund for a disabled adult or child as long as each individual involved meets the required conditions, including who counts as a disabled person, and what the trust fund would be used for. Good estate planning involves taking steps to ensure your estate is inherited by the people of your choice, in the manner and at the time you wish. Above all, it is about control; the desire to avoid certain outcomes whilst promoting others.

Why should you set up a Trust Fund?

There are many advantages to setting up a trust fund. Firstly, when a trust fund has been established it means that the trustees control when funds are made available. Funds can be paid gradually over many years and could be held for the next generation not yet born.

Trusts can also be used with life policies to ensure the proceeds are paid out more speedily in the event of death, as well as those payments falling outside the estate of the individual for IHT in many cases.

Setting up a trust fund also helps handle inheritance tax. If you make a gift and live seven years afterwards, its value is not added back to your estate on death, which gives a positive result for inheritance tax (IHT).

Trusts can be created in your lifetime as well as being written into a Will. The trustees own property which is held for the benefit of others, in line with the particular terms of the trust deed.

Rather than making a direct gift to a beneficiary, in which case there is no control over when or how the funds are accessed, those funds can be gifted to a trust. Assuming the amount involved does not exceed the current nil rate band for the tax year no immediate IHT bill arises.

Those in partnerships and owner-managed businesses may also find that their succession planning strategy could benefit from a trust being used with life policies.

Disabled and vulnerable persons Trust Funds

People caring or supporting for someone with a learning disability face many challenges every day and thinking about making long-term plans for a family member can be a daunting prospect. When you have made the decision to leave money to someone with a learning disability it is important you get the right advice for your individual circumstances.

By writing a Will and setting up a disability Trust, you can make sure that a family member with a learning disability will get the financial support and protection they need when you are no longer around.

Writing a Will can give you peace of mind for the future, especially if your son or daughter, for example, is unable to look after their finances themselves.

Making a Will enables you to make decisions as to how you want to dispose of your possessions, including property, for the benefit of your family and friends and any organisations or charities. Without a Will, you leave everything to the rules of intestacy. By making a Will you can ensure that your wishes will be carried out.

When a family member is affected by disability, and is unable to handle their own financial and legal affairs, consideration needs to be given to establishing a Trust in your Will. Without such provision, an application may have to be made to the Court of Protection to appoint a Deputy to manage the affairs of this family member. This can cause delays, and will involve expense in fees payable to the Court.

By including a Trust in your Will you can ensure that you protect the benefit entitlement of your family member, and thereby guarantee continuity and security of care.

You can also ensure that you make provision for "extras" that you want your family member to have. These can include things like holidays, and particular equipment to enhance someone’s quality of life.

We can give you specialist advice on writing a Will and setting up a Trust to protect your vulnerable or disabled child/family member.

Life interest Trusts

This is a trust that can be established either during your lifetime or by your Will. It is a trust that is established to provide the beneficiary with the right to receive the income from the trust during their lifetime and on their death, the trust passes to other named beneficiaries.

A common use for this type of trust is to hold a property. The life tenant would be entitled to live in the property during their lifetime or receive the rental income from it is entitled to either receive the rental income from it or to live in the property if they wish.

This type of trust may be useful in the following scenarios:

a. To protect your property if your spouse could remarries and the property could be inherited by their new family

b. Second marriages and step-children. This type of trust allows you to provide for your new spouse but ultimately allow your assets pass to your own children

c. Future care fees funding. This could allow you to protect some or all of your property to ensure that your children will receive some inheritance in due course, whilst potentially providing you with a rental income to help fund care fees

d. Keeping the family business in the family. Shares could be held in the trust

Discretionary Trusts

Discretionary trusts are a more flexible way of dealing with the unknown in terms of the destination of assets under a Will.

A discretionary trust in a Will allows your assets to be placed into a trust for the benefit of a group of individuals and your trustees will make decisions as to the use of the funds in the trust, potentially for many years and considering all the changing circumstances of the beneficiaries.

This type of trust is also a protective trust. You may have children or grandchildren with special needs and who cannot manage a large inheritance. The trustees will ensure that monies are available for that beneficiary without affecting their means tested benefits.

There is also a protection angle here. Many families may have had experience of dealing with someone who has an addiction of some kind or who is going through a difficult period in their lives, ie bankruptcy or a divorce; and a large inheritance may make a person vulnerable to outside influence which may potentially harm them. Again, your trustees can purchase items required by the beneficiary rather than pay out funds directly, which balances the desire to support the individual whilst not distributing cash which would inevitably be used for something else. Your trustees will take your place in protecting the monies in the funds whilst using them wisely for your beneficiaries.

The flexibility of this type of trust is one of its most attractive features. Weighed against all these benefits, there are professional fees involved in creating and running the trust and its investments, but for many families who want to secure these benefits to protect their wealth, it is a price well worth paying.

Please do not hesitate to contact a member of our Private Client team if you would like to discuss Trusts.

Mencap Recommended Advisor

Crombie Wilkinson Solicitors is one of Mencap's recommended solicitors to parents and carers of children with a learning disability, and is able to offer advice to parents and carers who are considering making their Wills to plan for the future of their vulnerable child. Crombie Wilkinson also regularly speaks at Mencap's Wills and Trusts seminars for parents in the area.

Sharon Richardson from our Private Client team is a Mencap recommended advisor for Wills and Trusts. Sharon can advise you on how you can include a gift to Mencap in your Will or Trust. As a charity, Mencap would not be able to survive without the legacies left to them so it is important that if you want to make a gift to charity that you speak to a recommended advisor who can guide you through the process.

Find out more from Mencap about leaving a gift to them in your Will.

National Autistic Society

The National Autistic Society have a list of specialist solicitors and we are now included in their list because of our experience working with people or in respect of supporting parents of children with autism.

Through our specialist work, we understand and have experience of the difficulties facing people with autism and their families when planning for the future.

To speak to a member of our Private Client team about trust funds for disabled adults or any questions you may have, contact us today from our offices in either York, Malton, Selby or Pickering.