Buying or selling commercial property can be a complex process due to building codes, lease agreements, and many other legal factors. Having expert legal guidance from a commercial property solicitor is fundamental to navigating the rules and regulations.

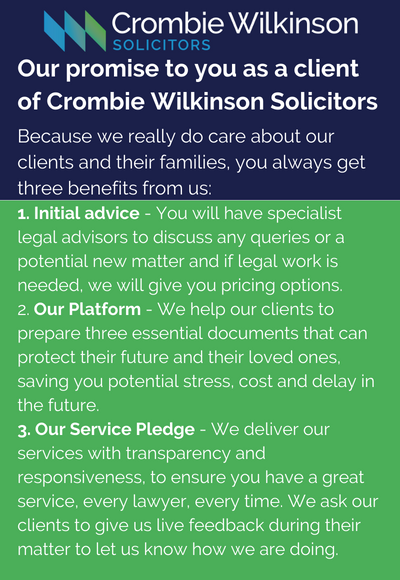

At Crombie Wilkinson, our teams in York, Selby, Malton and Pickering have years of experience in helping people and businesses to buy and sell commercial property of all kinds.

Buying commercial property

Buying commercial property involves legal assessments such as zoning laws, safety regulations, lease agreements and tenant rights. You also need to consider the implications of property taxes, purchase agreements, and sales contracts.

Ensuring all legal stipulations are met when buying retail and business property is important to avoid disputes in the future.

Read our commercial property overview for general guidance and additional information.

Benefits of buying commercial property

Commercial property buyers see a great many benefits, including:

- Passive income generation

- Property management control

- Mortgage interest over time

Buying commercial property through a limited company

When a limited company buys a commercial property, they become the legal owner. If you buy your commercial property through a limited company, you can expect:

- Tax efficiency: You only pay Corporation tax on your profits, rather than your rental income.

- Liability protection: The property is not in your name, reducing liability. You will only be responsible for your own investment.

- Financial ease: Securing loans is generally easier if you have commercial property assets.

Commercial property: Leasehold or freehold

Buying a freehold commercial property means you own it until you sell it. Buying a leasehold commercial property means you essentially lease it for an agreed upon number of years subject to extensions. Newly-made leases can be anywhere from 125 years to 999 years.

Freeholds benefit from the fact you are the outright owner and are free to do with it as you wish. A leasehold owner has to work within the term of the leasehold contract, which could limit who you can sell to and what work you can carry out.

The benefits of a leasehold purchase include:

- Lower initial cost: Leasehold purchases are generally cheaper than freehold.

- Increased flexibility: Commitment periods are usually shorter than freehold.

- Open freehold option: You can upgrade to freehold in the future.

Discover ways to finance a commercial property purchase here.

Tax information for commercial property purchases

You will need to check which property taxes apply to your commercial property investment. These could include, but are not limited to, the following:

- Value Added Tax (VAT): The tax added to the price of the property.

- Stamp Duty Land Tax (SDLT): A tax on property and land transactions in the United Kingdom

- Income Tax: A tax on income earned.

- Business Rates: a tax on non-domestic income, such as commercial property such as offices, factories and shops.

Selling commercial property

Selling a commercial property isn’t as straight forward as selling a residential home, as your income from the property needs to be considered.

Tax implications of selling a commercial property

When selling commercial property, Capital Gains Tax is (CGT) will be payable based on the profit made from the sale.

Rates vary between individuals and corporations - the former resting between 10% and 20%, and the latter around 19%.

If the property is subject to VAT, this could also affect the final sale price and potential tax obligations.

Selling with tenants

If you have existing tenants, you will need to carefully review commercial tenant rights to ensure that they are preserved, and that all lease terms are diligently documented, transparent and transitioned properly. You will also need to hand the lease over to the new owner.

Learn more about tenant rights here

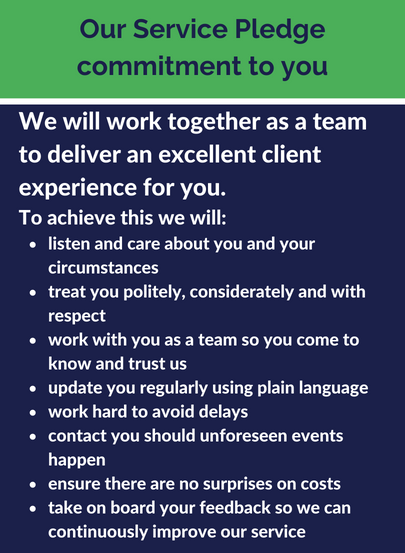

How Crombie Wilkinson can help with your commercial property transaction

We are a driven, expert team of commercial property legal advisors, and can apply our expertise to any aspect of buying or selling commercial property in the UK.

Whether your process is simple or complex, we will tailor our knowledge to your buying endeavours in a timely and professional manner.

Get in touch today for expert advice from experienced corporate property solicitors and buy a commercial property the smart way