How much does Probate cost?

The work which we will do will vary depending on the circumstances of an estate and no two estates are precisely the same. This will affect your probate solicitor fees, however, typically, our tasks will be divided into three stages.

What are the stages of Probate?

Stage one will consist of establishing the assets and liabilities of the estate, securing the property and establishing outstanding property costs, confirming the executors’ responsibilities, placing the statutory advertisement to protect the executors, and notifying the beneficiaries of the estate. Typically, this will take 3 – 4 months.

Stage two will consist of drafting the probate papers, to include the inheritance tax return, and overseeing their signing, submitting the relevant paperwork to obtain the probate, and arranging the payment of any inheritance tax. Typically, this will take 2 – 3 months.

Stage three will consist of gathering the financial assets and items of the estate, paying all liabilities, to include the preparation of an income tax return, if appropriate, carrying out necessary searches to protect the executors, distributing the estate and preparing estate accounts. Typically, this will take 3 – 4 months.

For more information on the stages of probate contact our Probate solicitors here, otherwise read on to find out more about our probate fees and pricing.

Our Probate pricing

We believe the three stages set out above cover the services that you may reasonably expect to be included in this type of work. Typically, the time involved overall would be between 15 and 20 hours, although a very straightforward estate would be less. We charge for this work on the basis of hourly rates ranging from £175 to £360 per hour (plus VAT at 20%). Higher hourly rates will apply to more experienced Legal Advisers who may be able to carry out the work more quickly so the final cost of the work which we do should not vary depending on the Legal Adviser.

The total costs for the work set out above are, therefore, typically, £3,000 - £7,200 (plus VAT at 20%).

With regards to the above total costs for work set out, this is for an estate which does not include complex inheritance tax issues such as claims for Business Property Relief or Agricultural Property Relief, nor does it include work needed if any disputes arise between beneficiaries or if there are claims against the estate either about the validity of a Will or whether someone claims under the Inheritance (Provision for Family and Dependants) Act 1975 nor if the estate includes a foreign element or business interests. Also if the estate is significant in value and as a result Inheritance tax is payable this fee range is likely to be exceeded because of dealing with HMRC. All of these complicating factors will mean that the estimate for the total costs is likely to be higher.

Please be aware if we are acting as Executors and this involves dealing with some of the more day to day things such as arranging house clearance, the funeral or visiting the property for insurance purposes because there is no family or anyone close to do this then this will have an impact on increasing the costs too over and above the total costs for work set out above.

Also, advising about Trusts contained in the Will and implementing those Trusts including reporting to HMRC will mean that additional charges will have to be made over and above the total costs for work set out above.

Apart from our own costs, there are payments which we have to make to other people which are known as disbursements. The first of these is taxes due to the Government. If an estate is liable to inheritance tax, that tax has to be paid before the Grant of Probate is issued. You can carry out a tax assessment. There may also be income tax due on an estate.

Other Probate expenses are likely to be as follows:

- Probate application fee - £300 plus £1.50 per sealed copy Grant of Probate (VAT is not applicable)

- Land Registry search fee - £3 (plus VAT at 20%)

- Bankruptcy search - £2 per beneficiary of a significant amount (plus VAT at 20%)

- Adverts in the London Gazette and a local newspaper to protect the Executors - £300 approximately (plus VAT at 20%)

We also offer a range of services for clients who only wish us to obtain a Grant of Representation. These vary depending on the complexity of the application. Please contact us for details of such fixed fee prices.

It would not normally be necessary to undertake other work or incur other costs other than those described above. However, we would be very happy to provide you with a more tailored quote for all stages of your particular case once we know about your specific circumstances.

You can see the legal advisers who work in our Probate Team.

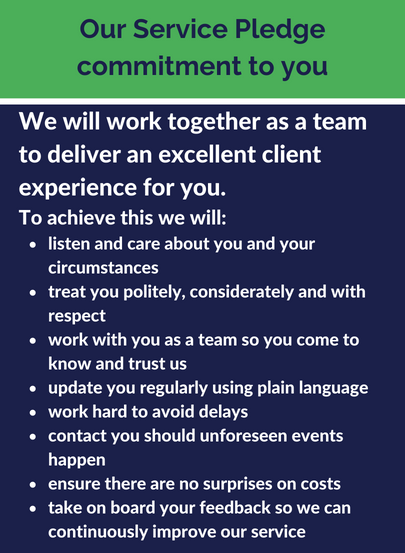

We want to give you the best possible service. However, if at any point you become unhappy or concerned about the service we have provided, please inform us immediately so that we can do our best to resolve the problem.