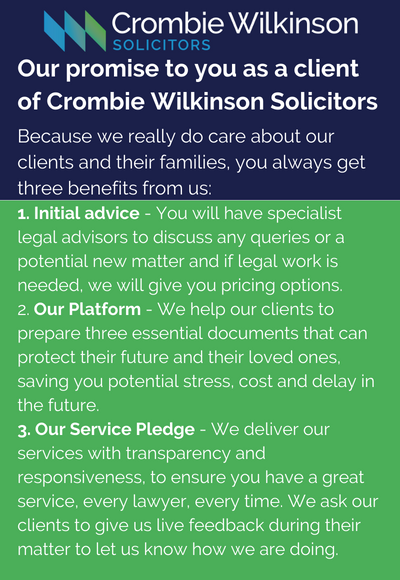

We have prepared a guide to answer pressing questions regarding Stamp Duty Land Tax - What is Stamp Duty? When does it apply? How much stamp duty do you pay? At Crombie Wilkinson, we have specialist conveyancing solicitors in York, Malton, Selby and Pickering who are ready to answer any questions you might have about Stamp Duty Land Tax as it applies to your unique situation.

Contact our conveyancing solicitors today.

What is Stamp Duty Land Tax?

Stamp Duty Land Tax – also referred to as SDLT - is a property and land tax that applies to the purchase of most residential and commercial properties or land in England and Northern Ireland.

There are different taxes that apply to land purchases in other parts of the UK: Land Transaction Tax (LTT) for Wales, with rates set by the Welsh Government, and the tax collected by the Welsh Revenue Authority; and, Land and Buildings Transaction Tax in Scotland, which is administered by Revenue Scotland. Whilst we can assist with purchases of land and property in England and Wales, we are unable to help with transactions of land and buildings in Northern Ireland or Scotland.

Stamp Duty is calculated and collected by HMRC (His Majesty’s Revenue and Customs) when you buy a property in the UK and is paid to HMRC. It is charged at different rates depending on what type of property you are buying and your circumstances. SDLT isn't just for new properties, it applies to second hand homes too.

Who has to pay Stamp Duty Land Tax?

In England and Wales, stamp duty rules mean that anyone buying a property or land over a certain price must pay tax on that property. Different rates apply for different groups of people: for example, most first-time buyers don't have to pay Stamp Duty on the first £425,000 of the property price if the property they are buying doesn’t cost more than £625,000. This is to encourage first-time buyers in the UK to step onto the property ladder and is known as ‘First Time Buyer Relief’.

How much are Stamp Duty rates?

There are different rates depending on the value of the property you are buying, so it's important to check how much you'll pay before making an offer.

SDLT current rates (correct from 23/9/2022) are:

- 0% on the first £250,000 of residential properties

- 0% on the first £425,000 for first time buyers buying a residential property worth £625,000 or less:

- 5% from 250,001 - £925,000

- 10% on from £925,000 to £1.5 million

- 12% on the remaining amount (from £1.5 million).

Example

You buy a house for £295,000. The SDLT you owe will be calculated as follows:

- 0% on the first £250,000 = £0

- 5% on the final £45,000 = £2,250

- total SDLT = £2,250

However please bear in mind that an additional 3% rate will be added to the current rates if you are purchasing an additional property (discussed below) or if you are a non-UK resident you may have to pay an additional 2% surcharge on the rates (discussed below). These surcharges apply to the first £250,000 of the purchase price unlike standard Stamp Duty rates, so (for example) purchasing an additional property for £300,000 would result in SDLT of £11,500 being due to HMRC.

How is Stamp Duty calculated?

Stamp Duty is calculated using a percentage based on the purchase price of your home, so the more expensive it is, the more you'll pay. The exact rates depend on a variety of circumstances, including whether you’re buying as an individual or as part of a business partnership, whether you also own other property or if you are a first time buyer, and whether you are classed – for SDLT purposes – as a non-UK resident.

Stamp Duty is based on the price of your property, not its value. So, if you buy a house at £250,000 and another one at £225,000, they will be treated, percentage rate wise, as being worth exactly the same for SDLT purposes (because they’re both in the ‘up to’ bracket of £250k for the current SDLT Rates).

You can use the Stamp Duty Land Tax calculator provided by the UK government to calculate how much Stamp Duty you’ll pay for your purchase of a property in England or Northern Ireland.

Contact our solicitors for more guidance.

When do you pay Stamp Duty?

According to Stamp Duty rules, the tax is paid when you buy houses, flats, offices, and other residential and commercial property which can also include land.

It is paid by the buyer within 14 days of completion (which is when you become the legal owner i.e. get the keys on a house purchase). It is not part of your mortgage repayments or the purchase price.

It’s also important to remember that SDLT isn’t just applied when someone buys their first house; if they want to buy another property at any point during their lifetime, they’ll have to pay SDLT again on the new purchase at the applicable rates at the time.

How to pay stamp duty

You have 14 days from the completion date to pay stamp duty. You can do this either by filing a return with the HMRC or asking your conveyancing solicitor to pay it on your behalf.

When does Stamp Duty not apply?

According to current Stamp Duty rules, if your property is worth less than £250k then there is no Stamp Duty payable. If you purchase property worth more than £250k then you’ll have to pay Stamp Duty on top of your purchase price, unless you qualify for First Time Buyer Relief. You also don't pay Stamp Duty when you sell a home - only when you buy.

If you’re buying a second home or an investment property, you will have to pay higher rates of Stamp Duty Land Tax at 3% on top of the ‘normal’ rate unless you are replacing your main residence, and if you are a non-UK resident you may have to pay an additional 2% on top of the ‘normal’ rates.

Do I have to pay Stamp Duty?

The short answer is yes, but it depends on your individual circumstances. The amount of Stamp Duty you will pay depends on the price of your property and a number of other factors, such as whether you are classed as resident in the UK and whether you are buying the property as a first time buyer, a second home, or a buy to let property.

There are two important things you need to know when you are working out if you have to pay SDLT when buying a house or land:

1. The price you are paying for your property or land (also referred to as the consideration), and

2. Whether VAT is applicable to your purchase

Contact our solicitors for more guidance on SDLT.

Transfer of equity and Stamp Duty rules in the UK?

Sometimes, a transfer of equity does require Stamp Duty to be paid. Under stamp duty rules, if you marry or enter into a civil partnership, your partner or spouse may pay Stamp Duty when you transfer a share in your property to them.

Stamp Duty on transfer of equity is payable if the chargeable consideration given in exchange for the share is more than the current SDLT threshold for the property type. If it is for nil value there is no Stamp Duty to pay unless there is a transfer of an interest in a mortgage.

If you transfer a share of your property to someone and there is a mortgage over the property, they will assume half of the current mortgage debt. If this debt is over the SDLT threshold then the tax will be payable.

There is no SDLT to pay when you transfer equity to your spouse as part of an agreement or court order due to reasons like divorce, annulment, or legal separation.

Stamp Duty on inherited property

When you inherit property, there's no Stamp Duty to pay. But you do need to consider that if you have inherited a property that you intend to keep and then purchase another property, you will face additional rate SDLT on the purchase, as this will result in you owning more than one property.

What about Stamp Duty and my mortgage?

Stamp Duty is a tax on land transactions (that is, the acquisition of property). Any security over the property, such as a mortgage, is not liable to SDLT. The same applies to when you remortgage.

However, you sometimes have to pay Stamp Duty on a property transfer between family members in the UK (perhaps from a parent to a child, or from husband to husband and wife for example).

If there is a mortgage existing on the property that transfers to the new owner, then the amount of that transferred debt will be chargeable for SDLT purposes.

How to claim back Stamp Duty?

There are some situations where you can reclaim back some or all of your Stamp Duty payments. For example, if it has been found that SDLT was paid at the wrong rate and this is accepted by HMRC, or if you can satisfy the residency rules where you have previously lived overseas and been charged the additional 2% surcharge; this is discussed below.

If you purchased an additional property with the intention of it becoming your new main residence/home but at the point of purchase you still owned your former main residence/home, you can apply to HMRC for the additional 3% SDLT to be repaid to you, provided that your former home is sold within 3 years from the date of purchase of your new one. There is a form provided by HMRC to enable this reclaim and payment is made directly back to you.

If you're a first-time buyer, you might be entitled to SDLT relief, however this does not apply if your first home purchase is for more than £625,000. In this case the normal rates of SDLT will apply.

You cannot normally reclaim Stamp Duty paid on a house when you sell it.

If you think you're due an HMRC refund on Stamp Duty, contact 0300 200 3510.

How much is Stamp Duty when buying a house?

The rates are set out at the start of this article; however, if you’re buying your first home and it costs less than £425,000, then SDLT will be charged at 0%. This means that if the price of your home is £500,000, you pay 0% on the first £425,000 and 5% on the remaining £75,000.

If you’re purchasing a property with someone else, then you’re classed as joint purchasers. In this case, both of you will be liable for paying SDLT if the purchase price is over £250,000 (or £425,000 if you are both first time buyers).

If you are buying an additional home, then you may face the additional 3% surcharge on the whole price. You should also bear in mind that if you are married but are purchasing a property in your name only, HMRC will consider properties owned by your spouse when calculating SDLT for your purchase. This could result in the additional 3% surcharge being payable on your purchase regardless of the fact that your spouse will not be named as an owner.

If you or your joint purchaser are not a UK resident (and you are not married or in a civil partnership), then you must also pay an extra 2% surcharge on the total consideration paid (if over £40,000). The rules are that this will apply if you have not been resident in the UK for at least 183 days in the 12 months prior to the date of your purchase; however, you may be eligible for a refund if you meet the residency requirement in the 12 months after purchase. Please note that if you are married and one of you meets the residency requirement then you are both treated as having qualified and the surcharge does not need to be paid.

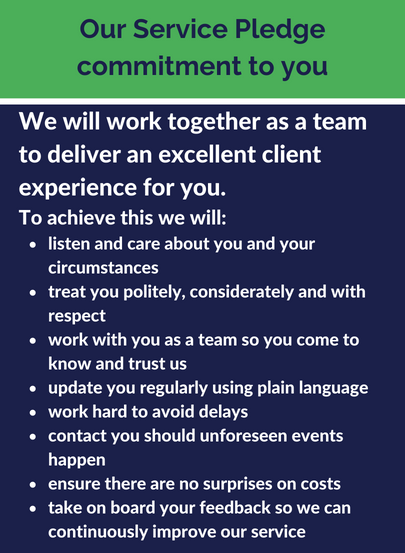

While it seems like a bit of a murky and complex area, SDLT can be straightforward when you get help from a solicitor. We have solicitors on hand to help you through the hassle of SDLT when buying or selling property.

Contact our solicitors today.