Our Inheritance Tax Solicitors can help you with tax planning for your Will. Calculating inheritance tax depends on the value of the estate and the beneficiaries. This is an important aspect of writing your Will and our Inheritance Tax Planning Solicitors are here to assist you with your questions.

Contact Our Team To Discuss Inheritance Tax Planning

What Is Inheritance Tax?

When someone dies, their estate may be subject to Inheritance Tax and the rate at which it is levied is 40%, one of the highest rates of taxes around.

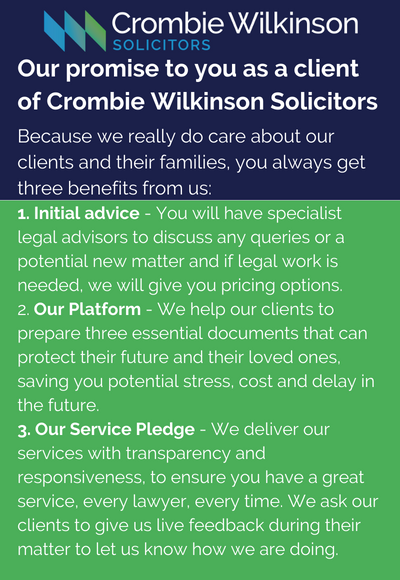

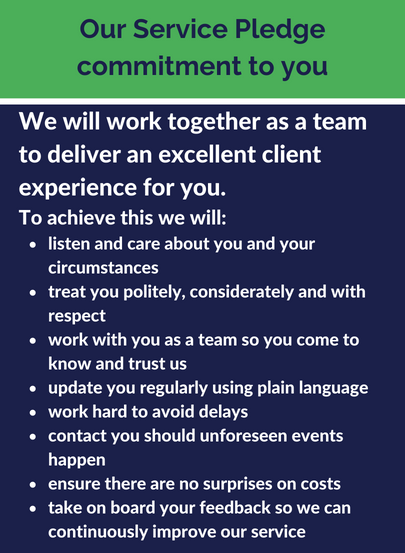

There is however a complex network of inheritance tax reliefs that requires specific legal advice to ensure your estates inheritance tax is sorted out correctly. Crombie Wilkinson can help you with this and are recognised experts in inheritance tax planning.

What Is the Inheritance Tax Threshold?

The first £325,000 of somebody’s estate is not taxed at all and, also, generally speaking, all gifts by way of Will or Intestacy to a spouse or civil partner are exempt. Additionally, where there is a couple and the second to die dies after September 2007, the second to die can take the benefit of the unused portion of the nil rate band of the first.

Call Us Now for Inheritance Tax Legal Advice

How To Avoid Inheritance Tax on Property

These arrangements mean a lot of estates do not pay Inheritance Tax but, for those who are wealthier, the following are some popular tax avoidance measures:

1. A lifetime substantial gift made more than 7 years before death will not be clawed back into the person’s estate and taxed. It is called a Potentially Exempt Transfer (PET). Any gift made within three years of death will be deemed owned by the deceased at death and any large gifts, will between three and seven years, be taxed on a sliding scale, decreasing by 20% per annum. So, if you can afford to give away some substantial money, do so sooner rather than later.

2. The first £3000 of a lifetime transfer in any tax year plus any unused balance from the previous year is exempt. Over a number of years, therefore, you can give away an appreciable amount of money.

3. Any gift up to £250 per annum to any number of people again is not taken into account and, on marriage/civil partnership, a gift of £5000 by a parent, £2500 by a grandparent or £1000 by any other person will not count.

For those in business, if certain conditions are met there will be relief in respect of the business assets of either 50% or 100%. For those who farm there is a similar type of relief of 100%. It may be a good idea, therefore, never to retire from the business so as to preserve this protection.

And let’s not forget charities: any gift to a registered charity is exempt, a very satisfying way of helping a chosen cause. Read more about leaving a gift to charity here.

In terms of strategy, think what you want, think what you can do and then take expert professional advice from our Inheritance Tax solicitors.

Crombie Wilkinson’s Tax Planning Solicitors Can Help You With:

- Inheritance Tax Planning

- Estate planning

- Filing Inheritance Tax Returns

- Transferring tax-free allowances to partners.

- Lifetime gifts planning.

- Charity gift planning.

- Charity and lifetime gifts planning to reduce inheritance tax on any gifts left in your Will.

- Creating/reorganising Wills and trusts to take advantage of inheritance tax.

Probate & Inheritance Tax

Inheritance tax can become even more complicated if there is no Will. Under the intestacy rules, which apply when someone dies without a Will, not all of the estate will necessarily pass to the surviving beneficiaries. If you are going through probate we can help with this and advise you on how to take advantage of any possible inheritance tax reliefs depending on your situation.

Our probate and inheritance tax solicitors can obtain the grant of probate and expertly handle the legal, tax, property, and estate administration on your behalf. Learn more about our probate services here.

Contact A Probate And Inheritance Tax Legal Specialist.

Can I transfer my tax-free allowance to my spouse/partner?

It is possible for married couples and civil partners to transfer a fixed amount of their personal allowance to the other, providing that the spouse transferring the allowance is not liable to income tax above the basic rate and the recipient is also not liable to income tax above the basic rate.

Please do not hesitate to contact a member of our Private Client team for help and advice.